Salzgitter AG gets serious and secures its pig iron base in the transformation phase with the lining of blast furnace A. But sustainability goes even further for the steelmaker: The Group and HGK Shipping promote sustainable supply chains on the waterway. But there is also good news on a purely commercial level.

With the relining of Blast Furnace A now commencing, the Salzgitter Group is taking an important operational step towards securing its hot metal base in the gradual transformation phase towards low-CO2 steel production by 2033. In a construction phase lasting around 100 days, Blast Furnace A will be overhauled – relined, as it is known in the steel industry. Among other things, the refractory lining will be renewed and the complex process and control technology modernized.

An important first step was now the tapping of the “furnace sow”, in which the remaining pig iron was drained from the blast furnace hearth. Just over 100 million euros will be invested in this complex construction project. A key partner is Pirson Montage AG. The supply of starting material to internal processing plants and sister companies during the construction phase is guaranteed due to the pre-production of slabs.

Ulrich Grethe, Chairman of the Executive Board of Salzgitter Flachstahl GmbH, explains the new lining: “This investment is a strong signal that we will continue to be a reliable partner for our customers in the transformation phase lasting until 2033. With Salcos (Salzgitter Low CO2 Steelmaking) we are pioneers of industrial transformation. The defined approach with investments in the existing operation and simultaneous construction of the new process route is a unique selling point in the steel industry.”

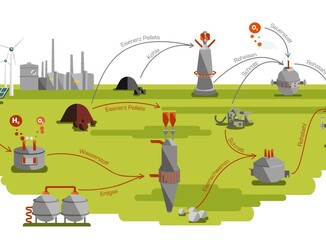

Gerd Baresch, Managing Director Technology Salzgitter Flachstahl GmbH, comments: “We are gradually leaving the blast furnace route and have already started to install the process route for new units such as direct reduction plants and electric arc furnaces. For example, we will be taking one of our blast furnaces out of operation as early as 2026. With this approach under Salcos, we are future-proofing the Salzgitter steel site and its jobs.”

Blast furnace A went into operation in 1977 and has been relined several times. It has an annual capacity of around 2 million tons of pig iron.

© Salzgitter AG

Sustainable transport

HGK Shipping and the Salzgitter Group intend to intensify their cooperation and jointly promote and expand sustainable logistics concepts on the waterway in the future. To this end, two subsidiaries of Salzgitter AG – Salzgitter Flachstahl and Deumu (Deutsche Erz- und Metall-Union) – and Europe’s largest inland shipping company signed a Memorandum of Understanding (MoU) in Salzgitter on August 10.

The overarching goal is to further develop and establish low-emission logistics chains. The focus is on the development and expansion of paired transports, i.e. the generation of return cargo in order to avoid empty runs, as well as on the optimized utilization of existing ship space. The intelligent combination and planning of transports are particularly suitable in this cooperation.

While Salzgitter Flachstahl specializes in the production of flat steel products, for example for vehicle and tube manufacturers and the construction industry, Deumu is active in the recycling and trading of steel scrap, metals and alloys. In their sustainability efforts, both Salzgitter companies intend to increasingly rely on the use of inland shipping in their logistics chains.

Salzgitter AG companies are connected to the waterway system at numerous locations, with the result that over one million tons of steel and steel pre-products are already transported annually by inland waterway vessel on Europe’s waterways. A share that can be further increased if the right conditions are created.

“Sandrina Sieverdingbeck, Managing Director of Deumu, explains the cooperation: “The Salzgitter Group has set itself the strategic goal of being a leader in the circular economy. A central component will be the use of steel scrap for crude steel production. This also includes the sustainable logistics of this so important secondary raw material. For example, we want to further expand the use of waterways as a transport route. This can only succeed with strong partners.”

Fabian Gerdes, Head of Customer Logistics SZFG, also underlines the importance of the intended cooperation: “We will also increasingly establish sustainable solutions such as inland shipping in the supply and logistics chains. This is sometimes given little consideration in public discussions and perceptions when it comes to the topic of traffic turnaround and relieving road congestion. Yet inland shipping is already one of the most sustainable modes of transport and elementary for the steel industry, offering short- and medium-term potential for increasing transport volumes.”

Florian Bleikamp, Head of Chartering Canal at HGK Dry Shipping GmbH, emphasizes: “The cooperation with the Salzgitter Group confirms to us that the need for sustainable solutions on the waterway system continues unabated. Sustainable solutions that meet the requirements of climate protection, economic efficiency and security of supply can only be created if we tackle the challenges together – industry and logistics hand in hand.”

Participation in the “Seafar” project

Digitization also plays a major role in this context. The cooperation partners agree to participate with their transports in the Seafar pilot project to test semi-autonomous inland navigation in Germany as soon as it is approved by the responsible authorities. To this end, dry cargo vessels used by HGK Shipping to and from Salzgitter are being retrofitted with the appropriate technology for remote control from shore. In the medium term, the close cooperation should also help to develop new and additional shipping space that meets the requirements of innovative and sustainable inland shipping and the needs of the steel industry for decarbonization and security of supply in equal measure. The signing of the MoU is now the starting signal for the further projects.

Successful in a difficult situation

Following the encouraging start to the financial year 2023 and a gradually deteriorating economic environment, the Salzgitter Group reported a presentable € 461 million in EBITDA and € 243 million in pre-tax profit in the first half of 2023. The Steel Processing and Steelmaking and Technology business areas made a particular contribution to this.

Despite the high level of investment, particularly in the implementation of the Salcos transformation program, net financial debt decreased compared with the prior-year period, while the equity ratio increased. This demonstrates the continued very robust balance sheet and financial basis of Salzgitter AG.

The Salzgitter Group’s external sales declined by 12 percent to € 5.8 billion (H1 2022: € 6.6 billion), mainly due to lower shipment volumes compared with the previous year’s period and lower average selling prices for many rolled steel products. With € 461.0 million EBITDA (H1 2022: € 1,138.5 million) and € 242.6 million profit before tax (H1 2022: € 970.5 million), a presentable result was generated.

The contribution of the investment in Aurubis AG included at equity (IFRS accounting) of € 29.3 million was noticeably lower than a year earlier (H1 2022: € 84.3 million). Earnings per share of €3.49 (H1 2022: €14.39) are calculated from €191.8 million (H1 2022: €781.0 million) after-tax profit.

Return on capital employed (ROCE) was 8.9 percent (H1 2022: 30.7 percent). The equity ratio improved to an extremely solid 44.8 percent (H1 2022: 42.2 percent). Net financial debt decreased by almost €280 million compared with the prior-year figure (€-624.3 million; H1 2022: €-901.4 million).

The Federal Republic of Germany and the State of Lower Saxony have pledged subsidies for the Salcos program, which will be paid out depending on the investments made. Of the grants requested for payment (€60 million; H1 2022: €0), no payment had been received as of the end of June. However, a significant portion of these investment grants has been paid in July 2023.

The Chairman of the Executive Board of Salzgitter AG, Gunnar Groebler, commented as follows: “Notwithstanding the clouding of the economic environment, the Salzgitter Group generated a gratifying half-year result. With the approval of a subsidy of around € 1 billion from the Federal Republic of Germany and the State of Lower Saxony for the construction of the first stage of Salcos, the order for the direct reduction plant and further partnering agreements in the areas of sales and energy, we achieved important milestones in the implementation of our Group strategy ‘Salzgitter AG 2030’ in the period under review. I am also particularly pleased with the first-time assessment of Salzgitter AG by the EcoVadis rating agency, which was successfully completed in June. We were certified with a bronze medal right off the bat. This award is an incentive for us to continue to improve. We have driven forward our portfolio management with the transfer of Salzgitter Bauelemente GmbH to its new owner and the sale of the Berg Pipe Group and will continue to do so consistently.”

CFO Burkhard Becker adds: “In view of the current considerable economic challenges in our core market of Germany, maintaining the sales and earnings forecast is not a foregone conclusion. Rather, it is also the result of the targeted diversification of our business activities and the “Performance 2026″ earnings improvement program, which is an integral part of the Group’s strategy. Particularly against the backdrop of the current economic situation, we continue to strive to reduce our working capital in the mid three-digit million euro range in the current fiscal year. This will contribute significantly to the funding of Salcos, as will the federal and state funding from which we received the first disbursement in July. This process should now become more permanent.”

Outlook

With a weaker second half of the year, as expected, and a persistently volatile political and economic environment, we continue to expect the Salzgitter Group to generate

– sales of between €11.5 billion and €12.0 billion,

– EBITDA of between €750 million and €850 million,

– a pre-tax profit of between €300 million and €400 million, and

– a noticeably lower return on capital employed (ROCE) than in the previous year.