“Medium-sized industries see a glimmer of light on the horizon. But nothing more – the costs are too much of a burden.” This is how the German Steel and Metal Processing Association (WSM) assesses the economic situation in light of the latest preliminary figures from the Federal Statistical Office. They show production growth of 10.4 percent in 2021 compared with 2020 – but also a drop of 3.5 percent compared with the pre-crisis year.

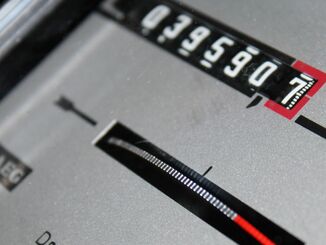

Whether the beleaguered automotive suppliers in particular will soon be able to make up further points is – in addition to overcoming the supply bottlenecks – a question of costs: Rising material, energy and logistics burdens as well as growing climate protection requirements are slowing down the catch-up process. “We urgently need political support here to maintain the international competitiveness of the manufacturing sectors and their jobs,” the WSM therefore demands.

Stable material and parts supply could further boost production growth

In 2021, material bottlenecks in particular halted production growth – according to WSM, the order situation and capacity utilization would otherwise have enabled a larger increase. Whether, when and how supply chains will ease in 2022 is still unclear, but automakers are cautiously optimistic about the second half of the year. This glimmer of light raises their suppliers’ forecast for the next six months by four percent. According to WSM, if material and parts supplies stabilize, production growth of around seven percent could even be achievable for 2022 as a whole.

Additional burdens hamper positive development

However, the glimmer of light on the horizon loses its luminosity if policymakers let companies down. This is because new clouds have long been gathering in the supplier skies: extremely rising input material, energy and logistics costs on the one hand and the demand for rapid transformation to CO₂-neutral production on the other. Even if the economy develops positively, these additional burdens will become an obstacle for the mostly medium-sized companies without political help.

Transformation: “Maintaining the international competitiveness of the manufacturing sector”.

“The German government must accompany the far-reaching adjustments around the transformation across all stages of the value chain. Just as we demand with the Carbon Border Adjustment Mechanism (CBAM),” emphasizes WSM CEO Christian Vietmeyer. The WSM expects German politicians to advocate this at the European level as well, in order to protect the international competitiveness of local companies.

About the WSM

The steel and metal processing industry in Germany is made up of around 5,000 predominantly family-run companies which, with more than 400,000 employees, generate sales of over 80 billion euros a year. The companies employ an average of 100 people and are by far the most important customers of the steel producers. The industry is characterized by high specialization and competitive intensity. The companies manufacture for the international markets of the automotive, electrical and construction industries, mechanical engineering and trade.

The WSM is the umbrella organization for 14 professional associations. Together, they bundle the interests of one of the largest SME sectors in Germany and are the mouthpiece for their economic policy representation at state, federal and European level. They seek a balance with powerful buyers and suppliers from industry and trade. And they are calling for better framework conditions for growth, dynamism and competition – whether in taxes, levies, law, research, the environment, energy or technology.

Web:

www.wsm-net.de